Employee Provident Fund is a very important tool of retirement planning. The tax free interest (compounding) and the maturity ensures a good growth of your money. If continued for a very long term, it can help immensely in meeting ones retirement goal. But while fulfilling other goals or during emergencies, we fall short of funds even after taking all recourse and do force borrowing. At this moment EPF can be helpful due to certain benefits it provides which most of us are unaware of.

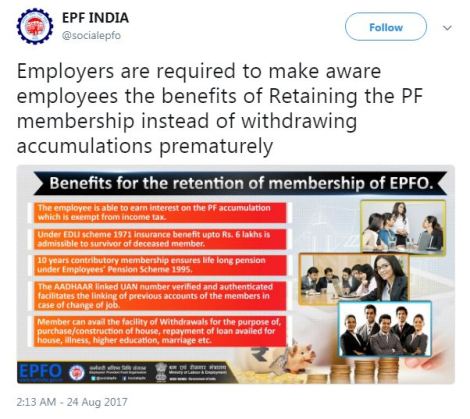

Here are the long-term benefits of retaining EPFO membership:

1) The employee is able to earn interest on the PF accumulation which is exempt from income tax. Financial planners say that EPF kitty should be meant for long-term savings, not to be withdrawn before one’s retirement. Your EPF account continues to earn interest even if it has been inoperative for more than 3 years, or 36 months. Last year, EPFO had rolled back its earlier decision not to allow payment of interest on dormant accounts. Financial planners say that even if your earlier PF account continues to earn interest, it is better to transfer the accumulation to the present account. Under the current tax rules, withdrawal of accumulated PF balance is taxable if the employee has not rendered continuous service for five years or more to the employer(s).

2) Under the Employees’ Deposit Linked Insurance Scheme, insurance benefit up to Rs. 6 lakh is admissible to survivor of deceased member.

3) 10 years of contributory membership ensures life-long pension under Employees’ Pension Scheme 1995. The retirement body has three social security schemes Employees’ Provident Fund 1952, Employees’ Pension Scheme 1995 and Employees’ Deposit Linked Insurance Scheme 1976 to provide provident fund, pension and group term insurance to its over four crore subscribers. Last year, the Labour Ministry had amended the Employees’ Pension Scheme 1995 to provide the entitlement of minimum monthly pension of Rs. 1,000 to pensioners.

4) The Aadhaar-linked UAN number (verified and authenticated) facilitates the linking of previous accounts of the members in case of change of job. Transferring your employee provident fund (EPF) accounts while changing jobs has become easier. New joinees are no longer required to file separate EPF transfer claims using Form-13 after changing jobs. It will now be done automatically. EPFO has introduced a new composite form called Form 11 that will replace Form 13 in all cases of auto transfer. This was stated by EPFO in an order dated September 20, 2017.

5) EPFO subscribers can avail the facility of withdrawals for the purpose of, purchase/construction of house, repayment of house, illness, higher education, marriage etc.

6) EPFO’s latest move to ease the withdrawal process will benefit nearly 4 crore subscribers.

7) The subscribers can seek advance from the fund for treatment of illness in certain cases including hospitalisation lasting for one month or more, or major surgical operation in a hospital, or in case they are suffering from TB, leprosy, paralysis, cancer, mental derangement or heart ailment.

8) Earlier, the members were required to submit a certificate from a doctor of the hospital that the member or his dependent has been hospitalised or requires hospitalisation for one month or more.

9) Now after change in employee provident fund laws, a member would no longer be required to submit any medical certificate or document.

10) For medical purpose, an EPFO subscriber can withdraw up to six months of salary.

11) EPPO has been taking a number of steps to ease withdrawal rules. Recently, it allowed subscribers to withdraw up to 90 per cent of their funds for home/land purchase. It also allowed payment of home loan EMIs by using the provident fund.

12) Partial provident fund withdrawal is also allowed for post-matriculation education of children and marriage purposes.

13) For various withdrawal purposes, the subscriber is now only required to submit a self-declaration, which is included in a claim form, to avail advance from the provident fund.

14) Subscribers who have seeded their Universal Account Number (UAN) with Aadhaar and bank account details can submit claim forms directly to EPFO without the attestation of employers. A universal account number allows provident fund number portability.

15) However, in cases where Aadhaar has not been seeded, the attestation of employers is required.

Follow Us @ Facebook, Twitter Contact US @ contactreadstudyshare@gmail.com

Please feel free to write your comments, suggestions or corrections.